If you're a product manager or product leader, I'm willing to bet you've been here: Leadership slides a deck across the table (or more likely, shares their screen on Zoom) and proudly unveils this year's "strategy" – Grow revenue 25%.

That's it. That's the strategy.

Maybe it's dressed up with some market analysis. Perhaps there's a competitive benchmark thrown in. But at its core, it's not a strategy – it's a goal masquerading as direction.

As I've written before, your strategy probably sucks. And this kind of "strategy" is exactly what I'm talking about. It's not making choices. It's not providing direction. It's not helping anyone understand how we're going to grow. It's just a number with an upward arrow.

Here's the thing, though: complaining about it won't change it, and waiting for a better strategy from above could take forever. The reality is that product people at every level need to stop waiting for permission and be strategic themselves.

So let's talk about how to transform a vague hand wave "grow 25%" into actual strategic choices that can guide your team's work.

The Power of Zooming Out: Your First Strategic Move

When faced with a vague growth target, our instinct is often to look at what we're already doing and ask, "how can we do more of it?" But that's tactical thinking, not strategic thinking.

Start With Context: What Does 25% Actually Mean?

Before you do anything else, you need to understand what "grow 25%" means in your specific context. This isn't about the math – it's about understanding the levers that drive your business.

Break down that growth target into its components:

- What drives revenue in your business? New customers? Expansion from existing customers? Reducing churn?

- What would 25% growth actually require? If you're at $24M ARR, that's $6M in new revenue. But where does that come from?

- What are the conversion points? If growth comes from new customers, how many leads do you need? What's your current conversion rate?

- What are the constraints? Can your sales team handle 25% more deals? Can your infrastructure support 25% more users?

Let me illustrate with an example. Imagine you're a product manager at a B2B SaaS company that provides customer feedback management tools. Your CEO just announced the goal: grow revenue 25% this year.

First, understand your growth levers:

- New customer acquisition brings in $300K/month currently

- Expansion revenue adds $100K/month

- You're losing $50K/month to churn

- Net growth = $350K/month or $4.2M/year

To grow 25% from your current $24M ARR, you need an additional $6M. That could come from:

- Increasing new customer acquisition by 50% (ambitious)

- Doubling expansion revenue (possible but challenging)

- Cutting churn in half (valuable but won't get you there alone)

- Or more likely, improving all three

Now you have context. You understand the scale of the challenge and the levers available to you. Your immediate instinct might be to optimise the onboarding flow you've been working on, or finally ship that enterprise feature customers have been requesting.

Stop. Zoom out even further.

This is where we need to map the entire opportunity landscape.

Learning to Think in Opportunities, Not Solutions

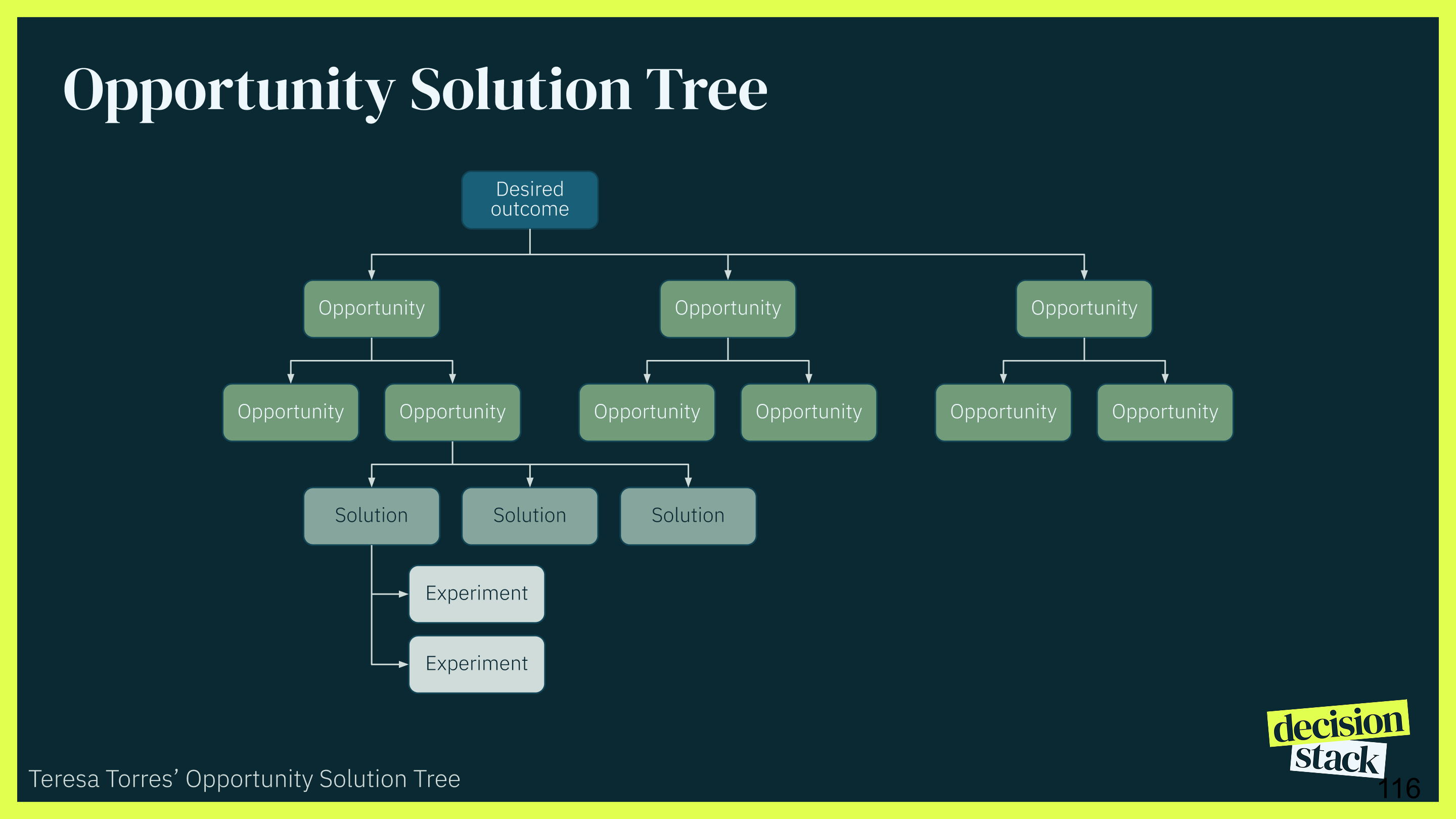

This is where Teresa Torres' Opportunity Solution Tree becomes your secret weapon. But before we dive into mapping, we need to rewire how we think. Most of us jump straight to solutions. We hear "grow 25%" and immediately think "new features," "better onboarding," or "price changes."

Stop. These are solutions. We need to train ourselves to see opportunities first.

An opportunity is an unmet customer need, a pain point, a desire – it's problem space, not solution space. Here's how to spot them:

- Listen for struggle in customer language: "I wish I could..." "It's frustrating when..." "I waste time on..."

- Look for workarounds: What are customers using spreadsheets for? What are they duct-taping together?

- Examine drop-off points: Where do users give up? Where do trials fail to convert?

- Study support tickets: What generates confusion? What requires human intervention?

- Analyse competition: What are we losing deals over? What do customers cite when they churn?

The key shift is from "What can we build?" to "What problems exist?" From "How can we improve our product?" to "Where are customers underserved?"

Mapping Your Opportunities

Start with the outcome – grow revenue 25%. Now, what are all the opportunities that could drive this outcome? For our B2B SaaS feedback tool, here's a sample:

Customer Acquisition Opportunities:

- Small businesses can't justify our current price point

- Mid-market companies don't understand our value versus competitors

- Marketing teams (a new segment) could use our tool for voice-of-customer programs

Expansion Opportunities:

- Current customers only use 30% of available features

- Power users hit limits and need higher tiers

- Teams using our tool want to expand to other departments

Retention Opportunities:

- New users don't reach their first value moment

- Champions leave companies and replacements don't see value

- Long-term customers feel taken for granted

Suddenly, "grow 25%" has transformed from a vague directive into a rich landscape of strategic choices.

The Strategic Filter: Which Opportunities Should We Pursue?

Here's where most product teams get stuck. We've identified a dozen opportunities – now what? Before we dive into impact calculations or attempt a prioritisation framework like RICE, we need to make some strategic choices about which opportunities even deserve further investigation.

Remember, you're not waiting for strategy from above anymore. This is you creating the strategy your organisation needs.

Strategy is fundamentally about making choices to focus our limited resources. The question isn't just "which opportunity is biggest?" but "which opportunity aligns with who we are and who we want to be?"

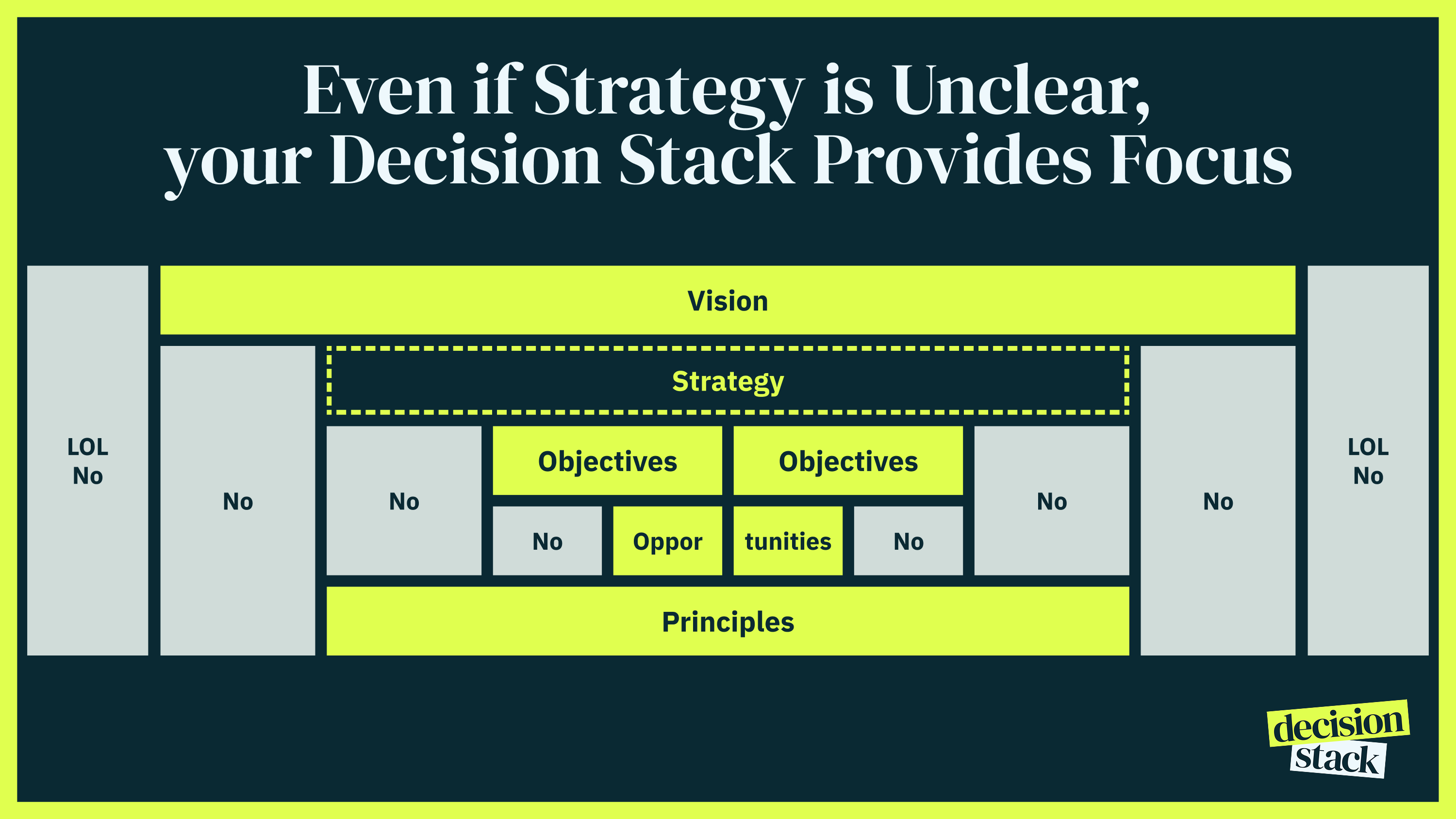

Even if your company's capital-S Strategy is lacking, you have more guidance than you think. Your Decision Stack – particularly your Principles – can act as a strategic filter. As I've written about in why your values are useless, Principles need to be specific and actionable. The best format? Even/over statements that force real tradeoffs:

- "Simple for many even over powerful for a few"

- "Speed to value even over feature completeness"

- "Self-service even over high-touch support"

Let's apply this to our B2B SaaS example. Say one of your principles is "Self-service even over high-touch support." This immediately influences your opportunity assessment:

- Small businesses can't justify our current price point ✅ Aligns – they need self-service

- Marketing teams could use our tool for VOC ⚠️ Tension – new use case might need hand-holding

- New users don't reach their first value moment ✅ Aligns – self-service onboarding critical

- Champions leave and replacements don't see value ⚠️ Tension – might require high-touch saves

Your Vision provides another filter. If your vision is to "make customer feedback accessible to every team," then opportunities that democratise access (lower price points, simpler interfaces, broader use cases) align better than those that add complexity or exclusivity.

Even past product decisions reveal strategic preferences. Did you previously choose to build integrations over advanced analytics? That suggests you value fitting into existing workflows over being a destination product. Did you prioritise mobile over API development? That implies end-users matter more than developers.

The point isn't to be a slave to past decisions, but to recognise that strategy is cumulative. Each choice should build on previous choices, creating a coherent compounding advantage rather than spreading resources across disconnected bets.

This strategic filtering might eliminate half your opportunities before you do any math. Good. That's strategy working.

The Reality Check: Which Opportunities Can Actually Deliver?

Now that we've filtered for strategic alignment, we need to be brutally honest about impact. Of the opportunities that align with who we are, which ones can actually move the needle on our 25% growth target?

As Matt LeMay discusses in his book Impact-First Product Teams, too many product teams hide behind abstract scoring systems like RICE instead of doing the hard work of connecting their efforts to actual business outcomes. Gabrielle Bufrem recently debunked a lot of these prioritisation frameworks, and Teresa Torres also emphasises this in her framework for assessing opportunities – assessment must be grounded in real impact.

For each strategically-aligned opportunity, do the napkin math:

- How many customers could this affect?

- What's the realistic conversion/adoption rate?

- What's the revenue impact per customer?

- Does this actually ladder up to our 25% growth target?

Let's be specific with our B2B SaaS example. We've already identified that "Small businesses can't justify our current price point" aligns with our principles. Now let's see if it can deliver:

- There are 10,000 small businesses in our addressable market

- We might capture 10% with a new tier (1,000 customers)

- At $99/month, that's $1.2M ARR

- That's 20% of the $6M we need for 25% growth

This isn't about precision – it's about honesty. As Matt notes, we need to measure impact in the same units as our goals. If the goal is revenue growth, measure revenue. If it's user growth, measure users. Not "engagement points" or "satisfaction scores" – the actual thing that matters.

Some strategically aligned opportunities will reveal themselves as unable to meaningfully contribute to your goal. That's not failure – that's clarity. Better to know now than after three months of building.

Let's say after our strategic filtering and napkin math, we've decided to focus on the small business opportunity. It aligns with our self-service principle, supports our vision of accessibility, and can deliver meaningful progress toward our growth target. Now what?

Strategy is Learning: Validating Your Choices

Making strategic choices based on principles and napkin math is a great start, but we need to validate that our assumptions hold up in reality. This is where we move from strategy to learning.

As I discuss in finding the courage to make choices, the key is to systematically de-risk our strategic bets. David Bland's work on Assumption Mapping and his book Testing Business Ideas provide the perfect framework here.

For our small business opportunity, what assumptions are we making?

- Small businesses actually want a feedback management tool (desirability)

- We can build a simpler version that still delivers value (feasibility)

- We can do this profitably at a lower price point (viability)

Now we can design experiments to test these assumptions:

- Desirability: Interview 20 small business owners about their current feedback management process

- Feasibility: Create a prototype of a simplified version and test it with 5 users

- Viability: Model the unit economics of a lower-priced tier

The key is to test our riskiest assumptions first, with the cheapest possible experiments. This isn't about building a full solution – it's about validating our strategic direction.

And remember – you're not doing any of this alone. Your engineers, designers, and data analysts should be part of this entire process. They'll spot opportunities you miss, challenge assumptions you take for granted, and ultimately help you build conviction in the strategic choices you're making together.

Strategy is Action: Execution > Thinking

Here's what most strategy frameworks miss: strategy isn't a one-and-done exercise. The process I've outlined – mapping opportunities, filtering them strategically, assessing their impact, validating assumptions – isn't a linear path that ends with a perfect answer. It's an iterative loop.

Strategic thinking without action is just an intellectual exercise. The real value comes from executing on your choices and learning from what happens. Each experiment, each customer conversation, each prototype test teaches you something that improves your next round of decision-making.

More importantly, this loop needs to spin fast. If you learn something that invalidates your strategic choice – maybe small businesses actually need enterprise-level features, or the market is smaller than you thought – you need to course-correct immediately. Don't wait for the quarterly business review. Don't wait for next year's planning cycle. Strategy is what you do, not what you plan.

The beauty of creating your own strategy from a vague directive is that you're not locked into someone else's yearly plan. You can adapt as you learn. You can pivot when the data tells you to. You can be genuinely strategic rather than just following a plan that was outdated the moment it was written.

Map. Filter. Validate. Execute. Learn. Repeat. That's how you turn "grow 25%" into real strategy that evolves with reality.

The Zoom Out Imperative

Here's my challenge to you: The next time you're handed a vague growth target, resist the urge to just optimise what's in front of you. Don't just dig into the solutions already on your roadmap.

Instead, zoom out. Use the Opportunity Solution Tree to map the entire landscape of possibilities. You might discover that the feature request you've been planning to build addresses a $500K opportunity, while there's a $5M opportunity sitting right next to it that nobody's noticed because we've been too zoomed in on our current solutions.

This is what being strategic really means – not waiting for a perfect strategy from above, but taking whatever direction you're given and transforming it into meaningful choices that can actually guide your team's work.

The tools are all there:

- The Opportunity Solution Tree to map your options

- Strategic filtering through your Vision and Principles to focus on what aligns

- Napkin math to ensure opportunities can actually deliver impact

- Assumption Mapping to de-risk your choices

- Your team's collective intelligence to spot what you'd miss alone

The question isn't whether you have enough strategic direction from leadership. The question is whether you're ready to create that direction yourself.

Your leadership gave you "grow 25%." That's not strategy, but it is permission. Permission to explore opportunities. Permission to make choices. Permission to be strategic.

So zoom out. Map your opportunities. Apply your strategic filters. Do the math. Test your assumptions. Bring your team along from the start.

Transform that vague growth target into real strategy. Your team needs it. Your customers need it. And frankly, your leadership needs it too – they just might not know it yet.

The strategy you're waiting for? It's not coming from above. It's going to come from you.